South Africa struggles with increased power cuts during electricity crisis

South Africans are struggling to cope with increased power cuts that have hit households and businesses across the country.

The post South Africa struggles with increased power cuts during electricity crisis appeared first on Digital Journal.

Apollo Brokers Partners with SecurityScorecard

Walnut, California – Apollo Brokers, the digital wholesale cyber insurance broker, has announced a partnership with SecurityScorecard to enhance the cybersecurity posture of every insured....

Raleigh NC Mold Testing and Remediation Boasts as The Go-To Mold Removal Company

Raleigh NC Mold Testing and Remediation is a top-rated mold treatment company. In a recent update, the agency outlined why it is the go-to company...

EV Connect Acquired by Schneider Electric to Accelerate EV Revolution

EL SEGUNDO, Calif. – July 2, 2022 – EV Connect, Inc., a premier electric vehicle (EV) charging solution provider, announced that it has been acquired...

Why System Of Records (SOR) is critical for Prepaid Card Issuers?

Wallet limit breaches and data duplications are crucial problems for prepaid card issuers. They hold the risk of consumers overriding the loading and spending limit.

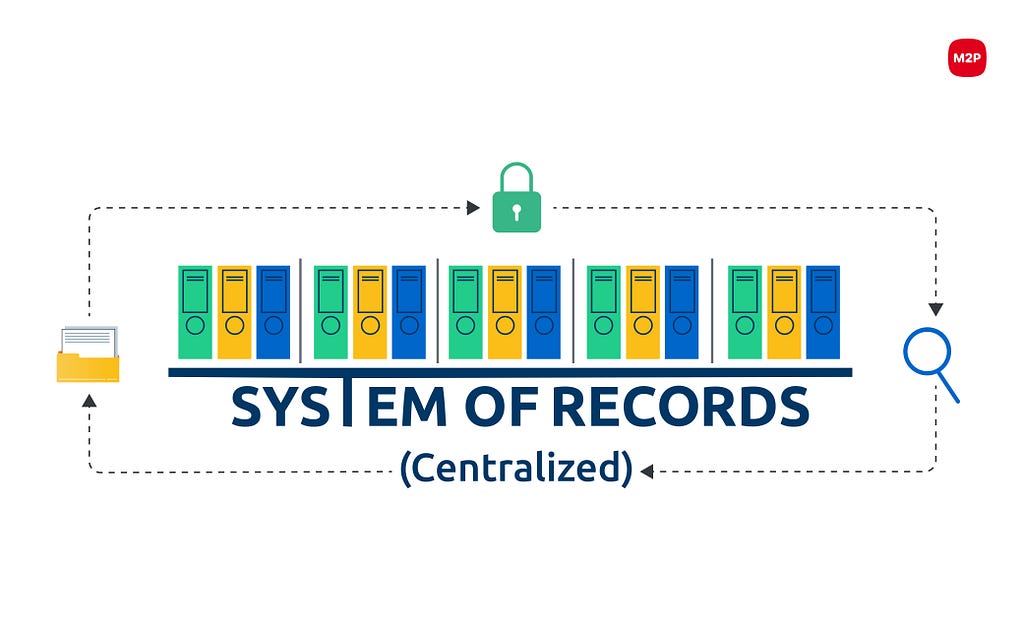

That’s why RBI mandated that all prepaid programs deploy a centralized System of Records (SOR) in October’17. All prepaid program partners must mandatorily connect to the issuer’s SOR system.

What is a System of Record?

A System Of Record (SOR) or Source System of Record (SSoR) is a single source of truth or data source that stores important information about a system or process within the organization. It serves as a shared reference point that protects prepaid card issuers against data repetitions that arise when individual data is created, handled, and processed by multiple individuals or business units. As a result, SOR provides a single source of truth for operations.

The System of Records monitors the consolidated prepaid balance of all wallets issued to the end customer by the same issuer, independent of the prepaid program partner. It is a central ledger that tracks every registered customer’s overall balance in real-time based on their KYC status. In addition to holding centralized data on the consolidated balance of a customer’s prepaid wallet, it also carries issuer-specific information. This is in cases where the balance of multiple partner wallets is integrated under a single PPI issuer.

How SOR works for prepaid cards?

Say an individual holds two prepaid wallets with the same issuer. His personal information is captured in the issuer database for profile creation and KYC verification. Issuers who partner with Token Service Providers for SOR will have all data automatically transferred to a centralized database. Then KYC-based wallet limit, dedupe check, and customer profile creation will need to be managed.

Why SOR is critical?

SOR is critical for prepaid issuers who deal with huge volumes of data from multiple source systems. This system of truth helps secure the integrity and validity of any data set as it remains the only source of truth. If there is any other agreed system of record, the data element must be either linked to or extracted from it. In other situations, the provenance and estimated data quality should be documented. Here are some key benefits SOR offers to users.

- Provides the most complete, accurate, and timely data

- Best structural conformance to the data model

- Nearest to the point of operational entry

- Can be used to feed other systems

How can M2P facilitate SOR implementation?

We help banks and prepaid card issuers build a SOR, which will serve as a final source of truth for all customer data. Our robust API-led infrastructure offers a centralized database to track and monitor the data in real-time. The built-in checks and balances comprise AML, negative listing, and real-time watch listing capabilities to ensure compliance and zero limit breaches across programs.

Looking to implement SOR for prepaid cards?

We would like to help. Write to us at [email protected].

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.

Why System Of Records (SOR) is critical for Prepaid Card Issuers? was originally published in M2P Fintech on Medium, where people are continuing the conversation by highlighting and responding to this story.

Rise of Wearables in Payments and Banking

Expected to reach $20.64 billion by end of 2022, wearables are here to stay. Not just in healthcare, retail, and telecom, but also in banking and payments. Changing customer priorities and fintech advancements accelerated the market for wearables in the pandemic era. With millennials, gen X, and gen Z consumers wanting secure, convenient, instantaneous transactions, contactless wearables are the way to go.

Projected to grow at a CAGR of 11.5%, the future of wearables is likely to evolve further as consumers and financial institutions transition into the cashless, digital universe. Some wearable payment devices have the potential to become a “one-stop-shop” for several services.

Disney’s Magic Band for instance is a wearable that Disney Land provides its visitors. Designed in the form of a funky wristband, the magic band functions as an access key, a payment device, and a personalized tracker. And it is also compatible with diverse smartphones and technologies.

What are wearable payment devices?

Wearable payment devices are apparel, gadgets, and accessories we use to make contactless payments. The most common types are smartwatches, belts, jackets, fitness trackers, and even rings. They use services like Apple Pay, Samsung Pay, and Google Pay to connect the device with the consumer’s bank account.

Top wearable payment devices in the market

Apple Watch

The Apple Watch is one of the most popular smartwatches on the market, and it features NFC (Near Field Communication) technology. This technology allows the watch to communicate with other NFC-enabled devices, such as smartphones, to exchange data, make mobile payments, and do other contactless transactions.

Jawbone UP4 Fitness Tracker

The fitness tracker Jawbone UP4, supports contactless payments by partnering with American Express. The UP4 is Jawbone’s latest smartwatch, which is water-resistant. So you don’t need to worry about it getting wet.

Samsung Gear G3

Samsung Gear G3 offers contactless payment services through Samsung Pay. It works with Android devices and uses NFC technology and magnetic secure transmission to make payments. The Gear G3 can be linked to a Samsung account to make payments at any NFC-enabled terminal.

Ringly

Ringly offers rings and bracelets that connects to your phone via Bluetooth. Partnering with MasterCard, they allow you to make contactless payments apart from tracking your activities. They allow you to make contactless payments with just a wave of your hand.

Now we’ve seen only a sample of wearable devices. Belts, jackets, and even shoes are used as wearable payment devices today.

How do wearable payment devices work?

To use a wearable payment device, say a smartwatch, the user needs to link the device to a credit card or bank account. Once the device is linked, the user can make payments by simply tapping the device against a payment terminal. The payment is then processed through the credit card or bank account that is linked to the device.

Wearable payment technologies

Wearable payment systems are quite commonly used in e-banking and payment platforms. They operate on technologies such as HCE, Barcode, Contactless Point of Sale, Radio Frequency Identification (RFID), and Near-field Communication (NFC) to enable payments and cash transfers.

Host Card Emulation (HCE)

Host Card Emulation (HCE) enables payments that are activated by NFC technology. It allows a device to emulate the functionality of a smart card to provide contactless payment capabilities using the ISO/IEC 7816–4 APDU command set. It communicates with a reader and stores data in the same way that a smart card would. A key benefit of using HCE is that it does not require a physical smart card or a built-in NFC reader. And it can be used for loyalty programs and access control too.

Barcodes

Some wearables are encoded with scan-and-go application barcode scanners for payments. It allows the customer to check out quickly without conventional processes. Barcode technology offers several advantages in wearable devices. They are secure, can be read quickly and easily, and can store a large amount of data. Newer barcode standards, such as QR codes can be deeply encrypted to prevent unauthorized access.

Contactless Point of Sale (CPOS)

The contactless point of sale (CPOS) is a new technology that uses Radio Frequency Identification (RFID) technology to communicate with the POS terminal and make payments. The CPOS system is fast, convenient, and secure. You just hold your card near the POS terminal, and the payment will be processed automatically. It uses the latest encryption technology to protect personal information.

Radio Frequency Identification (RFID)

RFID wearables such as rings, wristbands, and dongles comprise an embedded chip with an RFID tag. The tag is a unique identifier that an RFID reader can read. The reader can track the tag’s location or access wearer information. RFID-enabled wearables offer many advantages over traditional ID payment devices. They are more difficult to lose or misplace and can be read from a distance, making them ideal for tracking assets or people.

Near-field Communication (NFC)

NFC is a short-range wireless technology that enables two devices to communicate when they are near each other, typically no more than a few centimeters. It is a convenient way to share small amounts of data between devices and works great in wearable payment devices, such as smartwatches, fitness trackers, and clothing.

Wearables, IoT, and Fintech

As with many things to do with digital transformation, the pandemic pushed businesses to explore and invest in Point-of-Sale (POS) technology, making wearables more than just useful tools. Readily available and user-friendly in usage and navigation, payment apps such as Google Pay and Apple Wallets, have made it easy for all demographics to transition smoothly into wearable technology.

In the current mobile climate, using the Internet of Things (IoT) in banking is the way to attract new customers and retain existing ones. Wearable payment devices and IoT helps the financial sector to gain deep customer insight and improve user experience. Banks implementing IoT have seen benefits in cost savings, higher efficiency in business processes, and better customer experience. They have also been able to build new revenue models.

There is no doubt that Fintech needs wearables, as it opens up new opportunities to transform their businesses and remain strong contenders in the market. We see the increasing use of wearables and in a way, they may even replace mobile phones in the future.

How wearables benefit banks and fintechs

Access to data

Wearables provide banks access to voluminous data as they are worn by customers most of the time. Customer intelligence gained can be used to enhance experiences and personalize products and services. Wearables are critical to data extraction and analytics.

Personalization of customer service

Financial institutions and fintechs today recognize the need to be customer-centric. And data extracted from wearables have proven to personalize and optimize customer interactions. Wearables can help predict customer behavior through real-time data and target them with recommendations and personalized offers.

Omnichannel user experience

A combination of IoT and wearables can make all the difference in omnichannel customer experience. Fintech and banks can gain a competitive edge with wearables, for example, using smartwatches to make ATM withdrawals and biometric-enabled transactions.

Risk assessment

Banks and fintechs need to mitigate risk by assessing potential factors. Analyzing customer data extracted from wearables can help enhance risk management decisions on lending, or insurance, among many others.

Banking Wearables in India

India is fast catching up in the wearables market, especially after RBI increased the limit for contactless transactions to Rs. 5000. Both SBI and Axis Bank have launched their wearables Titan Pay and Wear n’ Pay, respectively.

Titan Pay

Titan Pay is a wearable collaboration between Titan and SBI that offers watches to enable contactless payments. It comprises a mobile app that allows users to send and receive money instantly. Using the watch and the app, users can transact in multiple currencies, track spending, and even set up a budget.

Wear n’ Pay

Wear n’ Pay devices include accessories like key chains and watch loops from AXIS Bank. It allows you to pay for purchases by just swiping your wrist. The system uses a special wristband that you can wear while you shop. You simply swipe your wristband across the payment terminal to pay for your purchase.

To conclude

The integration of wearable & contactless payments is an emerging trend in the modern payment system. While digital payment trends keep on changing, the need to provide the best consumer experience across the platform is always constant for Financial Institutions and Payment Service providers.

At M2P, we provide the best customizable payment experiences for businesses. Using our end-to-end API stack, we ensure that modern innovations and technology are seamlessly integrated into your ecosystem. Our APIs enable channel management and limit management in PoS, Contactless Payments, Ecommerce, Withdrawal on our Cards Issuance Platform.

Want to know more about integrating contactless payments and other customizable features on your payments platform?

Write to us at [email protected].

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.

Why Payments Interoperability is a Must for Today’s Generation?

Imagine you own a digital wallet. Its primary function is to let you spend viz., shop with partner merchants, make payments, and transfer money to other wallets and bank accounts. Then the same wallet offers a card (any authorized card network Visa, Mastercard, RuPay) to facilitate card-based in-store and online payments. Further, the wallet also comes with a UPI virtual ID to allow payments via QR codes and UPI.

This is payments interoperability making life easy for you.

What is Payments Interoperability?

Now, there are several definitions for interoperability. But at its core, it is the basic ability of multiple digital systems, applications, and databases to connect and communicate with each other.

Payment platforms leverage financial technology to connect and share data among ecosystem partners, viz., banks, payment gateways, payment processors, merchants, and consumers. This integration helps carry out transactions between payment service providers, third-party processors, and other networks without hassles. The interoperability occurs at the origination point, at the network level, or through an intermediary, both in national and international payment systems.

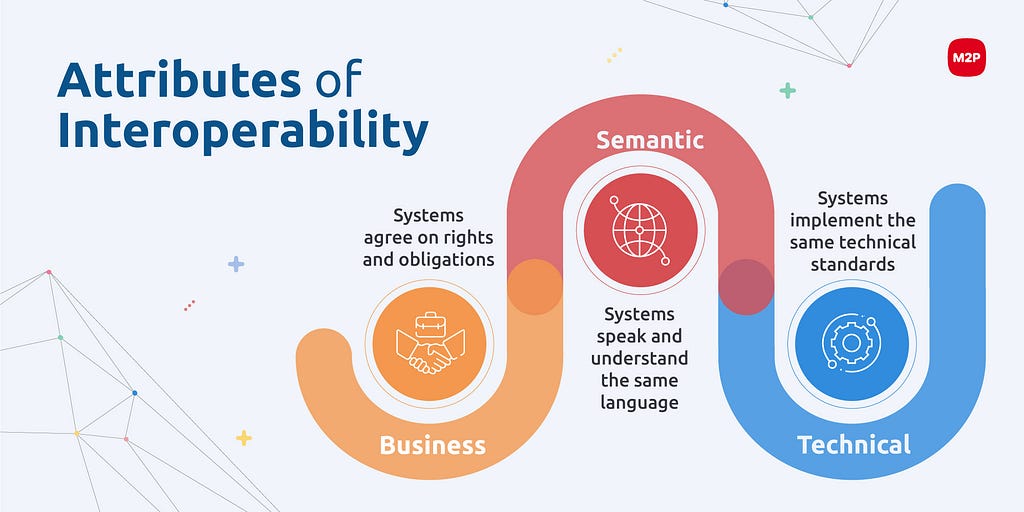

Here are a few common attributes of interoperability.

Payment system interoperability can be at domestic (national) and international levels.

National Payments Interoperability

National payment interoperability is limited to payment systems within a single country. National interoperability usually involves the same type of accounts. It happens between:

- Deposit accounts issued by various banks

- e-money transaction accounts offered by mobile network operators

National interoperability is ensured through bilateral agreements between Payment Service Providers (PSP) and Payment Systems Infrastructures (PSIs). Or through a centralized interoperability solution, with standardized regulatory measures stipulated by the central bank.

RBI’s Mandate for Domestic PPI Interoperability

Governments and Central Banks are giving interoperability a significant push to accelerate cashless ecosystems. RBI aims to make interoperability mandatory for all full-KYC Prepaid Payment Instruments (PPIs) and acceptance infrastructure by 31 June 2022. The move is to drive inclusion in cashless payments, and optimally utilize payment instruments like cards and wallets, given the constraint of scarce acceptance infrastructures like point-of-sale (POS) devices, ATMs, QR codes, and bill-payment touch points. Any user who signs up for a wallet, payment card, or UPI on PPI rails should be able to make digital payments via any network.

LivQuik is the first PPI issuer in India to achieve full interoperability as mandated by the RBI. This feat enables customers to enjoy optimized card and UPI payments across wallets. Similarly, initiatives like Central Bank Digital Currencies (CBDC) will further drive interoperability, inclusion, and innovation.

Need for Interoperable Cross-Border Payments

Interoperability in cross-border payments is critical to making financial services accessible, affordable, and reliable. It involves coordination between multiple stakeholders, including central banks and regulators. It encompasses technical, regulatory, and usage interoperability to enable quick, convenient, secure, and seamless transactions regardless of the Financial Services Provider (FSP) network.

According to a recent Visa survey, only 50% of merchants have a cross-border trade-compatible payment processing infrastructure. Without globally interoperable payment systems, small and medium-sized merchants cannot tap into international trade and markets. Interoperability levels the playing field and eliminates the inefficiencies of a closed-loop payment systems, i.e., payments between users of only one payment provider.

An end-to-end interoperable platform delivers access to cross-border payment services through an integrated gateway. It enhances the user experience through its ease-of-use customer onboarding and digital KYC.

A centralized interoperability platform calls for stringent global regulatory compliance and data security standards for utmost security. It enables faster reconciliations with real-time reporting and data-driven insights into payment patterns and customer behavior. Moreover, an automated platform saves time, reduces human error, and cuts costs. It enables infrastructure and data sharing which helps tech-driven payment ecosystems reach economies of scale.

While international interoperability comes with a few challenges, it can be overcome with the support of the regulators, the global schemes, and with a compatible business model across international borders and technology.

India’s Global Partnerships with Cross-Border Payment Networks

A clear example of an interoperable cross-border payments partnership is that between India’s UPI and Singapore’s PayNow. The need for faster cross-border payments and financial inclusion has been a catalyst in establishing the link between India and Singapore. The interoperable link between UPI and PayNow, enables instantaneous, cost-effective, and transparent payments across borders.

Now for those new to UPI, it is India’s real-time payment system with a Virtual Payment Address (VPA). It is completely mobile-based and supports person-to-person (P2P) and person-to-merchant (P2M) payments and funds transfers.

And PayNow is Singapore’s real-time payment system available to all participating banks and non-bank financial institutions. It is also a mobile-based system and enables peer-to-peer funds transfer using mobile numbers, VPA, or Singapore NRIC/ FIN. The UPI-PayNow partnership is only the beginning and is established to foster faster and smoother transactions between India and Singapore.

India also holds strategic partnerships with the following payments networks and banks to enable seamless, interoperable international transactions.

- Discover Financial Services (DFS), US

- Japan Credit Bureau (JCB), Japan

- Union Pay International (UPI), China

- Royal Monetary Authority (RMA), Bhutan

- Mashreq Bank, UAE

- Lycra Network, France (in the pipeline)

Benefits of Payments Interoperability

Interoperability benefits the entire payment ecosystem, including customers, merchants, end-users, and businesses. In addition to enhancing user experience and helping mitigate security risks, it delivers the advantages below.

- Payment flexibility: The ability to accept all forms of payments is a game-changer. Universal payment acceptance helps customer retention and increases customer reach. Though there are several digital payment systems and digital offerings from payment system providers, customers are not required to sign into multiple systems and complete their KYC many times. Interoperability brings issuers and acquirers together to undertake, clear, and settle payment transactions across payment systems, ensuring universal payments and consumer retention.

- Faster payment system: Electronic transactions are the key to reconciling and collecting payments, unlike cash-based systems. Advanced technology and fast internet connectivity make it easier to increase the speed of transactions.

- Secure payment and POS integration: Integration pushes the transaction directly to the payment terminal and eliminates manual entries, thereby enhancing security.

- Low operational costs: Integrated payment platforms reduce operating costs and seamlessly communicate with multiple devices across different financial service providers. It helps save money on adding new payment terminals.

Addressing Challenges — Getting it Right

Getting interoperability right through open API- based platforms is a start toward harnessing and expanding the payments ecosystem. Interoperability can be tricky when dealing with legacy systems. Technical challenges usually comprise systems that use different technical standards, communication protocols, and related software and hardware infrastructure. Another common challenge relates to data and semantics. Payment systems may use different languages and need to be translated. Inadequate translation leads to corrupted or lost data.

It is crucial to address the regulatory, technical, and business challenges of interoperability to make cross-border payments affordable, faster, transparent, and inclusive. Strategic partnerships with fintech firms, banks, exchange houses, and Money Transfer Operators (MTOs) with a focus on regulatory compliance and technology innovation will pave the way to overcome challenges and enable frictionless international transactions.

Need of the Hour for Today’s Generation

Payments interoperability is the linchpin of today’s digitized economy. When done right, it can lead to greater convenience, speed, reliability, security, and seamlessness. It is the need of the hour today, as it enables people from all walks of life to benefit from the convenience that the cashless economy offers. It can increase service offerings, reduce costs, empower the end-user and help improve payment systems. Thus, interoperability is a strong facilitator for financial inclusion.

By leveraging API-based cross-border payment platforms with simple integrations across domestic switches, bank accounts, mobile wallets/e-wallets, MTO transfers, and forex card solutions, we can enable financial inclusion and seamless payments across APAC and MENA regions. With India to start with and then extended globally.

Along these lines, M2P is proud to partner with LivQuik for UPI services on exiting PPI offerings like cards, wallets, gift certificates, and other products. Thereby enabling interoperable payments on the LivQuik platform.

Want to know more about building interoperable payment systems?

Write to us at [email protected].

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.

Why Payments Interoperability is a Must for Today’s Generation? was originally published in M2P Fintech on Medium, where people are continuing the conversation by highlighting and responding to this story.

How The Metaverse Promises The Real World Experience The World Wide Web Shunned

The internet was a clunky technology in 1995 that promised to change the world. Consumers didn’t understand it, and pundits mocked its significance. The internet, as we know it, eventually went on to transform the world, emerging as one of the most significant technological leaps of our lifetime.

Now, twenty-seven years later, we find ourselves at a similar juncture. Web3 promises to turn our world upside down and make the advances realized by the internet seem small by comparison.

And yet 99.9% of my sophisticated network (and the rest of the world) can’t comprehend it, explain it, or appreciate the life-changing impact that it will have. To put it bluntly, nearly everyone has no clue what’s coming.

Perhaps one of the most misunderstood concepts in Web3 is the metaverse. It is a concept that has been ridiculed just like the “World Wide Web” before it. Yet, the metaverse is merely a term that reflects a future iteration of the internet. Let me explain.

A Generational Technological Shift Upon Us

The internet is a massive collection of interconnected computers that can be easily explored through a centralized set of navigation tools and standardized address schemas. Web3 is the next generation of the internet.

We are in the early stages of transforming the back and front end of the internet into something much more powerful and meaningful. The ultimate goal is to mirror our offline experience in an online format.

Undeniably, the current iteration of the internet delivers a digital experience that is convenient and efficient but at a cost that most people don’t realize. Yes — it provided streamlined communication. However, it simultaneously disconnected us from our family and friends.

Case in point, our children no longer talk to each other and instead choose to communicate through texts, apps, emojis, and GIFs. We stopped printing pictures to decorate our homes with curated collections for our visitors to enjoy. Instead, we post them on social media, chronicling our lives for our followers to consume at their leisure.

Even the digital shopping experience is flat and more akin to the days when people browsed the Sears Roebuck catalog that they received in the snail mail. Intimate connections with people and experiences are rapidly disappearing in this vacuum.

The metaverse promises to move us forward by bringing it all back!

Recreating The Offline Experience Online

Let’s go back to the digital shopping experience for a brief moment. When you shop on Amazon for a TV, you’re browsing a digital version of a printed catalog you would have formerly received in the mail or newspaper.

The difference is that it can be updated instantly and is integrated with social media features that allow you to see what other people think about it. Moreover, it is connected with ecommerce tools that enable you to instantly consume what you want rather than placing a phone order or visiting a store.

Shop Instacart for groceries, and you’re essentially doing the same thing — scrolling through a dynamic two-dimensional digital catalog to pick out foodstuffs. With the metaverse, that experience will be relegated to the past, delivering all of the positive aspects of visiting a physical store without the inconvenience.

The first phase of the metaverse involves reconstructing the web from a flat two-dimensional experience into an immersive, interactive three-dimensional experience that resembles a massive multiplayer video game like Fortnite.

Instead of scrolling through a digital catalog to buy your groceries, you will enter a supermarket with an avatar representing your identity. That avatar will be pushing a digital cart down the aisles as you pick up food items, examine them, and deposit them in your cart before moving on to the next aisle.

The new customer journey will resemble the real-world experience of shopping that is threatened with extinction by Web2. The metaverse allows us to reclaim our past while still preserving the efficiencies powered by the internet, like dynamic content, ensuring we see the latest products as soon as they arrive instead of awaiting the next catalog in the mail.

Back To The Future

Phase two of the metaverse is a few years away and will take us even further into our past. In the next version, avatars and the cartoonish objects of today’s metaverse experience will be replaced with virtual reality.

You will put on a VR headset before entering a virtual supermarket and walking down virtual aisles that look and feel like you are actually there. Consider the Zoom experience that is quickly replacing phone calls and in-person meetings. The metaverse will bring you closer to the real world in a digital format.

Still, like any progressive technology, some externalities present challenges. For instance, when you can experience reality virtually, why leave your home? Today, the internet makes shopping more efficient because it’s quicker and cheaper than going into a store.

The tradeoff as you forego the experience that traditional merchandising delivers — the curated visual and tactile experiences. Furthermore, you lose the sensation created from being in a crowd experiencing the reality as you.

Movie theatres and sports venues still exist for that very reason. Being surrounded by people in the same venue amplifies the sensations enveloping our experiences. If the metaverse solves this missing link in Web 2, reality as we now know it will be replaced by its virtual counterpart and deliver everything but the physical act of walking through the store.

Now, let’s return from the metaverse store to our virtual home in the metaverse. Instead of sharing your life linearly on social media, you’ll be able to invite people into your home and offer a curated experience, sharing your life in an immersive format that mimics someone visiting your offline reality.

This is just a glimpse of what the future of the metaverse will provide from a front-end perspective. For just a second, consider the benefits of community-based ownership and governance models, trustless transactions, transparency, and so much more underpinning this from the back-end. Although metaverse technologies applied to the front-end of user experiences exhibit so much unrealized potential, more lies beneath the surface, just like an iceberg.

I’ll share more about this in my next article exploring the metaverse’s underbelly.

Dan Nissanoff is a startup technology entrepreneur. He has founded leading companies in Web1, 2 and 3, and is currently the CEO of Game of Silks (silks.io) a derivative metaverse porting the thoroughbred horse racing industry into web3.

How The Metaverse Promises The Real World Experience The World Wide Web Shunned was originally published in Entrepreneur’s Handbook on Medium, where people are continuing the conversation by highlighting and responding to this story.

Debunking 8 Ridiculously Popular Myths About Running a Profitable Business

It’s entirely possible to buck convention, shirk the rules, and still succeed; in fact, doing so just may help you get there faster.